The number of SaaS companies worldwide has fluctuated over the past few years, as some companies have gained users’ attention while others have not. At the same time, the estimated number of SaaS companies may vary depending on the definition used.

However, the number of SaaS companies in the United States is currently estimated to be 9,100, and that in the UK is estimated to be 1,500.

Let us take a detailed look at the number of SaaS companies worldwide, in different countries and regions, market share and market cap of SaaS, and other details.

How Many SaaS Companies Are There: Top Picks (2024)

- There are over 17,000 SaaS companies worldwide as of 2024.

- The United States has the highest number of SaaS companies, amounting to 1,900.

- The US has over 15 billion SaaS consumers worldwide.

- The global Saas market is estimated to be valued at $232.3 billion in 2024.

- Microsoft is the top SaaS company with a market capitalization of $2.3 trillion as of 2023.

Total Number of SaaS Companies Worldwide

According to the latest estimates, there are over 17,000 SaaS companies worldwide as of 2024.

However, according to a survey conducted by Vainu, there are around 72,000 SaaS companies worldwide. However, these 72,000 included the companies that have been acquired. As a result, the number of SaaS companies comes down to around 30,000.

Most of these SaaS companies belonged to the big data, retail, and developer tools industries.

Further, the survey stated that 175,000 company websites on the internet were labeled as SaaS companies in 2022.

Source: Vainu

How Many SaaS Companies Are There In The United States?

According to the latest data, the number of SaaS companies in the United States is 9,100.

The United States has the highest number of SaaS companies worldwide. Together, the SaaS companies in the US have over 15 billion consumers worldwide.

Silicon Valley is home to many top enterprise SaaS products and companies, including Google Workplace, Jira, HubSpot, Slack, GitHub, Atlassian, Figma, Xero, Salesforce, and Zoom.

Two-thirds of the top 100 are located in this area. The top five SaaS companies in the United States, Microsoft, Salesforce, SAP, Oracle, and Google, are in California, Washington, New York, Massachusetts, and Utah.

Source: Statista.

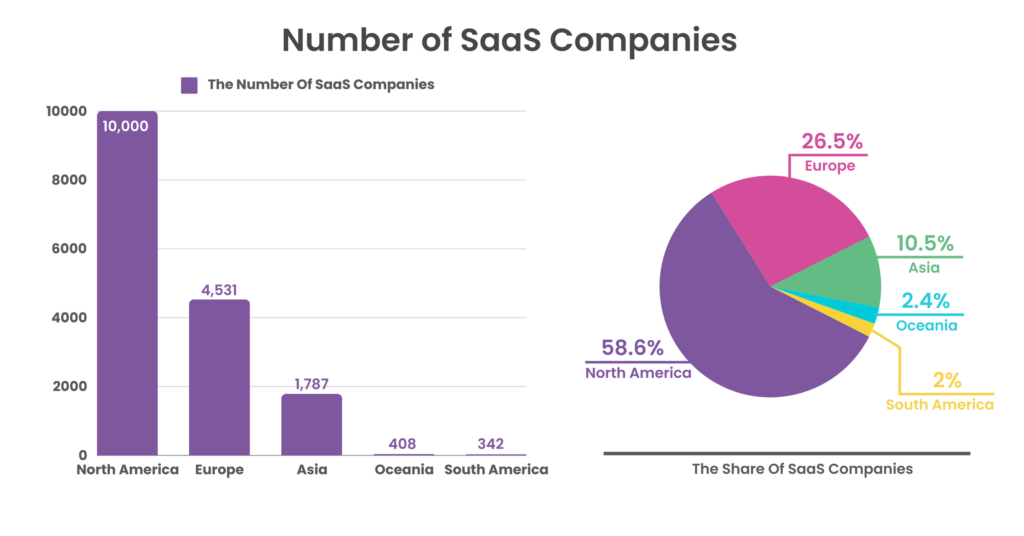

SaaS Companies By Region

Over half of the SAAS companies worldwide are located in the United States. Besides, the top 11 of the top 20 SaaS developing countries are in Europe.

On the other hand, the Oceania region and South American region have the lowest number of SaaS companies compared to other regions.

Interestingly, no African country appears among the top SaaS producers on the list.

Now, let’s see the SaaS companies sorted by region:

| Region | The Share Of SaaS Companies | The Number Of SaaS Companies |

| North America | 58.6% | 10,000 |

| Europe | 26.5% | 4,531 |

| Asia | 10.5% | 1,787 |

| Oceania | 2.4% | 408 |

| South America | 2% | 342 |

Note: Only the top 20 countries are used to calculate the regionwise share and number of Saas companies.

Source: Exploding Topics.

SaaS Companies By Country

The United Kingdom has the second-highest number of SaaS companies worldwide, with 1,500 companies in the country. These SaaS companies serve 293 million consumers worldwide.

Besides, the number of SaaS companies in the United States is around 6 times more than that in the United Kingdom.

Canada, Germany, and India follow the United States with 992, 840, and 711 saas companies.

The following table displays the countries with the highest number of Saas companies.

| Top Countries | The Number Of SaaS Companies |

| The United States | 9,100 |

| The United Kingdom | 1,500 |

| Canada | 992 |

| Germany | 840 |

| India | 711 |

| France | 684 |

| China | 443 |

| Australia | 408 |

| Brazil | 342 |

| Spain | 341 |

| Israel | 459 |

| Netherlands | 393 |

| Singapore | 327 |

| Sweden | 283 |

| Ireland | 268 |

Europe is experiencing a significant increase in SaaS companies, with the United Kingdom, Germany, and France taking the lead.

Source: Statista.

New SaaS Startups Launched by Year

As per the available data, most SaaS startups were founded between 2012 and 2018. During this period, 8,960 SaaS startups were founded.

In 2015, 1,469 new SaaS businesses were founded, and 1,460 new ones were founded in 2017.

However, in 2018, this figure declined to 1,196. In 2019, the number of new businesses that were founded declined even further, reaching a low of 674, the lowest number seen in almost a decade.

The most recent data on SaaS startups shows that 679 and 377 SaaS companies were founded in 2023 and 2022, respectively.

A table shows here the number of Startups launched from 2010 to 2023.

| Year | The Number of SaaS Startups |

| 2010 | 689 |

| 2011 | 832 |

| 2012 | 1083 |

| 2013 | 1197 |

| 2014 | 1247 |

| 2015 | 1469 |

| 2016 | 1308 |

| 2017 | 1460 |

| 2018 | 1196 |

| 2019 | 674 |

| 2020 | 114 |

| 2022 | 377 |

| 2023 | 679 |

Source: Exploding Topics, Crunchbase.

The Number Of SaaS Companies By Segment

These SaaS companies operate in different segments, with over 24,000 Productivity Tools and Collaboration Apps alone.

In addition, approximately 17,000 websites are operating in the Customer Service Solutions segment, 15,000 in Marketing Software, 14,000 in E-commerce, and 12,000 in Data & Analytics. The sales sector has 11,500 SaaS websites.

A table shows the estimated number of SaaS companies by Segment.

| Segment | The Percentage Of SaaS Websites | Number Of SaaS Websites |

| Productivity and Collaboration | 23% | 24,365 |

| Customer Services | 16% | 17,035 |

| Marketing | 14% | 14,822 |

| E-commerce | 13% | 13,946 |

| Data & Analytics | 11% | 12,359 |

| Sales | 11% | 11,559 |

| Human Resource | 8% | 8,265 |

| Finance | 5% | 5,453 |

Source: VAINU.

SaaS Market Size Statistics

Saas Market is estimated to be valued at $232.3 billion in 2024.

The SaaS industry has experienced tremendous growth over the past seven years, with its value increasing from $31.4 billion in 2015 to $197.29 billion in 2023.

Moreover, the industry continued to grow steadily in 2022, reaching a worth of $167.34 billion. Experts project that the industry will keep expanding and anticipate it will be worth $232.3 billion by the end of 2024.

The global SaaS market was valued at $167.34 billion in 2022 and is expected to reach $896.2 billion by 2030.

The following table provides further details about the market size of SaaS over the years.

| Year | Market Size Of SaaS |

| 2030* | $896.2 billion |

| 2024* | $232.3 billion |

| 2023 | $197.29 billion |

| 2022 | $167.34 billion |

| 2021 | $146.33 billion |

| 2020 | $120.7 billion |

| 2019 | $102.1 billion |

| 2018 | $85.7 billion |

| 2017 | $58.8 billion |

| 2016 | $48.2 billion |

*Projected

Top 5 SaaS Companies By Market Share

Microsoft dominated the global software as a service (SaaS) market, accounting for 10.9% of the market share in 2021.

Other notable players in the industry include Salesforce, SAP, and Google.

The following table displays the top 5 SaaS companies with the largest market share as of 2021.

| Top SaaS Company | Market Share |

| Microsoft | 10.9% |

| Salesforce | 9.8% |

| SAP | 4.5% |

| Oracle | 3.6% |

| 3.4% | |

| Others | 67.8% |

While no single company dominates the SaaS market, the top five companies held around 33.3% of the market share globally in 2021.

Top Saas Companies by Market Cap

Microsoft was the largest global SaaS service provider in 2023, with a market cap of $2.3 trillion.

Alphabet(Google) followed Microsoft with a market cap of $1.6 trillion.

Other SaaS companies with a high market capitalization in 2023 were Oracle and Adobe.

The following table displays the market capitalization of the leading SaaS companies worldwide.

| SaaS Company | Market Capitalization as of 2023 |

| Microsoft | $2,329 billion |

| Alphabet (Google) | $1,630 billion |

| Oracle | $287.31 billion |

| Adobe | $230.77 billion |

| Salesforce | $197.02 billion |

| SAP | $149.53 billion |

Source: Statista.

The Number Of SaaS Unicorn Companies

A unicorn company is privately held with a valuation of at least $1 billion. There are over 1,200 unicorns worldwide as of 2023.

Of these, around 337 unicorns belong to the SaaS industry.

Some of the most well-known SaaS Unicorns worldwide are Salesforce, Microsoft, Oracle, SAP, Stripe, Zapier, Airtable, Scale AI, etc.

Source: CB Insights, Exploding topics.

SaaS Companies By Founding Year

It’s not surprising that SaaS companies are relatively young. About 73% of all SaaS companies were founded after 2010.

Although there are a few older companies in the graph, it’s worth noting that they may not have started as SaaS companies and only recently added a SaaS offering to their portfolio.

Therefore, they are now considered SaaS vendors.

However, most companies in this industry are young, with 93% of SaaS companies not existing in 2000.

A table shows the complete insights into it.

| Founding Year of SaaS Companies | Share of SaaS companies |

| Before 1950 | 0.12% |

| 1950 to 1990 | 1.94% |

| 1991 to 2000 | 6.58% |

| 2001 to 2010 | 18.47% |

| 2011 to 2015 | 29.43% |

| 2016 to 2019 | 32.93% |

| After 2020 | 10.54% |

Source: VAINU.

Conclusion: There Are Over 17,000 SaaS Companies Worldwide In 2024

The SaaS market is experiencing a surge, and as a result, the number of SaaS companies is increasing.

With the increased adoption of cloud computing by industries and consumers alike, SaaS business spending and revenue are expected to grow, motivating more companies to prioritize SaaS.

Hence, it will be interesting to witness the growth of the SaaS market in 2024 and the later years.

FAQs

SaaS become popular because it provides customers with cost savings, increased convenience, and scalability. Vendors benefit from a faster time to market.

The United States has six times more SaaS companies than any other country, and cloud security is the fastest-growing IT security segment.

The Rule of 40 is a principle that suggests a software company should aim for a combined revenue growth rate and profit margin of at least 40%.

90% of SaaS startups fail to reach their expected level of success and generate revenue. The study also found that 42% of SaaS startups fail because there is no market need for their product.

In 1999, Salesforce introduced its customer relationship management (CRM) platform as the first software-as-a-service (SaaS) solution developed from the ground up. The platform achieved record growth.